Anúncios

Earning money back on everyday purchases has become a smart financial move. More people are choosing reward programs that put cash in their pockets. With the right strategy, you could save over $500 a year.

WalletHub’s 2025 report shows a 22% rise in bonus category offerings. This means more opportunities to maximize your earnings. Matching a card to your spending habits is key to unlocking higher returns.

Anúncios

Not all reward structures work the same. Some offer flat rates, while others focus on specific purchases like groceries or gas. Your credit score and lifestyle also play a role in finding the ideal fit.

Key Takeaways

- Reward programs can help you save hundreds annually.

- Bonus categories have expanded, offering more earning potential.

- Flat-rate and category-specific options cater to different spending habits.

- Your credit tier influences which cards you qualify for.

- Personal spending patterns should guide your selection.

What Are Cashback Credit Cards?

A simple change in how you pay could boost your savings effortlessly. These financial tools refund a percentage of what you spend, turning routine buys into earnings. Unlike complex points systems, they offer straightforward value.

How Cashback Rewards Work

Every purchase earns you a rebate, typically 1%–8% of the total. The Amex Blue Cash Preferred®, for example, gives 6% back on groceries. Funds can be redeemed as statement credits, checks, or direct deposits.

WalletHub found 68% of users save more with category-specific cards. Here’s how cashback stacks up against other reward types:

| Feature | Cashback | Points/Miles |

|---|---|---|

| Redemption Value | Direct dollar amount | Varies by program |

| Flexibility | Any purchase | Partner restrictions |

| Ease of Use | No conversions needed | Blackout dates may apply |

Why You Should Consider a Cashback Card

They fit seamlessly into your routine. Whether fueling up or stocking your fridge, you earn without extra steps. “Cash back cards are worth it because they can save you 1%-8% on purchases when balances are paid monthly,” notes a 2025 industry report.

Annual savings can exceed $500 with strategic use. Just ensure you pay balances in full to avoid interest charges.

Types of Cashback Credit Cards

Reward programs come in different shapes, each designed to fit unique spending styles. Whether you prefer consistent returns or higher earnings in specific areas, there’s an option tailored to your habits. Below, we break down the three main structures.

Flat-Rate Cashback Cards

These offer a fixed rewards rate on all purchases, typically 1.5%–2%. The Citi Double Cash® stands out with its 2% return—1% when you buy and 1% when you pay. Ideal for those who want simplicity without tracking categories.

Bonus Category Cashback Cards

Cards like the Chase Freedom Flex® boost earnings in select areas (e.g., 5% back on groceries). “Bonus categories cap high-rate spending, so check quarterly limits,” advises a 2025 industry report. Common fixed categories include:

- Groceries (up to 6% with Amex Blue Cash Preferred®)

- Gas stations (3%–5% returns)

- Dining (4%–5% with select issuers)

Rotating vs. Fixed Bonus Categories

Rotating cards (e.g., Discover it® Cash Back) change categories quarterly but require activation. Fixed options like Bank of America® Customized Cash let you pick one category for 3% back. Note: Most cap bonus rewards at $1,500 per quarter.

How to Choose the Best Cashback Credit Card

Smart shoppers match their plastic to their purchasing patterns for maximum returns. The right card turns routine buys into earnings, but only if it fits your budget and habits. Start by analyzing where your money goes each month.

Assessing Your Spending Habits

Track your expenses for 30 days. Focus on high-volume categories like groceries, gas, or dining. Cards like the Amex Blue Cash Preferred® excel in specific rewards categories, offering 6% back at U.S. supermarkets.

Use this simple formula to estimate annual savings:

- ($600/month groceries × 6%) − $95 annual fee = $337 net

Three tools simplify tracking:

- Mint (automatic categorization)

- YNAB (budget-focused)

- Spreadsheet templates (customizable)

Understanding Reward Caps and Limits

Many programs limit high-rate earnings. For example, 5% bonuses often cap at $1,500/quarter. Exceed that, and you’ll earn just 1%.

“Calculate expected savings by subtracting annual fees from projected rewards,” advises WalletHub. Also note:

- Chase’s 5/24 rule may block approvals if you’ve opened 5+ accounts in 24 months.

- Some cards charge 1%–3% foreign transaction fees.

| Factor | Impact |

|---|---|

| Annual Fee | Reduces net rewards unless offset by high spending |

| Credit Score | Determines eligibility for premium cards |

Best Cashback Credit Cards for Flat-Rate Rewards

Flat-rate rewards simplify earning without tracking categories. These tools offer a fixed percentage on all spending, ideal for those who prefer consistency. With no bonus caps or rotations, they’re the ultimate set-and-forget choice.

Top Picks for Unlimited Cash

The Wells Fargo Active Cash® leads with 2% unlimited cash back on purchases. New users also get a $200 bonus after spending $1,000 in the first three months. No annual fee makes it a standout for high-volume spenders.

For a zero-fee option, the Capital One Quicksilver delivers 1.5 cash back on every buy. It’s perfect for travelers too—no foreign transaction fees. “1.5% cash back is a solid starting point for flat-rate cards,” confirms a 2025 industry report.

Annual Fees vs. Perks

Military families should consider the PenFed Power Cash Rewards. It offers 1.5% back plus waived fees for service members. Compare this to premium cards with higher rewards rates but annual costs.

Here’s how top options stack up:

| Card | Rewards Rate | Annual Fee | Foreign Fee |

|---|---|---|---|

| Wells Fargo Active Cash® | 2% unlimited cash | $0 | 3% |

| Capital One Quicksilver | 1.5 cash back | $0 | 0% |

| PenFed Power Cash Rewards | 1.5% | $0 (military) | 1% |

APRs vary widely—expect 18.24% to 28.49% in 2025. Always pay balances monthly to maximize returns.

Best Cashback Cards for Bonus Categories

Strategic spending in key areas can multiply your rewards effortlessly. Cards with bonus categories offer higher returns on specific purchases, from groceries to travel. Matching your highest expenses to these rewards categories maximizes annual savings.

Groceries, Gas, and Dining

Foodies favor the U.S. Bank Altitude® Go for its 4% back on dining—no annual fee. For fuel, the Costco Anywhere Visa® delivers 4% on gas (up to $7,000/year).

Compare top options:

- Amex Gold: 4% dining (terms apply) vs. Citi Custom Cash®’s 5% top category.

- Blue Cash Preferred®: 3% back on transit, 6% groceries.

Watch for exclusions: Wholesale clubs like Sam’s Club often don’t qualify for supermarket bonus rewards.

Travel and Entertainment

Frequent flyers earn 3%–5% on flights and hotels with cards like the Bank of America® Travel Rewards. Entertainment categories vary—some exclude streaming services.

Seven rare categories banks rarely cover:

- Rent payments

- Utility bills

- Medical expenses

- Tuition

- Cryptocurrency

- Peer-to-peer payments

- Government fees

“Always check fine print—some ‘travel’ cards exclude ride-shares,” warns a 2025 WalletHub report.

Cashback Cards with No Annual Fee

Annual fees shouldn’t eat into your hard-earned rewards. Many options deliver solid returns without yearly charges. You can earn up to 2% on every purchase while keeping all your savings.

Leading No-Fee Options

The Discover it® Cash Back stands out with 5% rotating categories and dollar-for-dollar first-year match. Other top picks include:

- Citi Double Cash®: 2% flat rate (1% at purchase, 1% at payment)

- Chase Freedom Unlimited®: 1.5% base plus 3% dining/drugstores

- Bank of America® Customized Cash: 3% in your chosen category

These credit cards often include purchase protections like extended warranties. Some even offer rental car insurance—valuable perks typically found on premium cards.

When Fees Make Sense

A $95 annual fee card becomes worthwhile if you spend:

- $3,167/year in 3% categories (vs 2% no-fee card)

- $1,900/year in 5% categories (vs 2% no-fee card)

“Calculate your breakeven point by dividing the fee by the reward difference,” advises a 2025 WalletHub report. For example:

$95 annual fee ÷ (0.06 – 0.02 grocery rewards) = $2,375 spend needed

Watch for hidden costs on “no fee” products:

- Foreign transaction fees (typically 3%)

- Balance transfer charges (3%-5%)

- Cash advance fees (5% or $10 minimum)

No-fee back cards often have lower initial limits. However, responsible use can lead to increases over time.

Cashback Cards for Excellent Credit

Your strong credit history unlocks premium financial tools that pay you back. Those with 720+ FICO scores qualify for the most rewarding card offers available. These products often combine high earning rates with valuable perks.

Premium Options for High Scorers

The Alliant Cashback Visa® delivers 2.5% flat-rate rewards on all purchases. While it carries a $99 annual fee, heavy spenders can easily offset this cost. Cardholders with 800+ credit scores often receive $15,000+ limits.

Three rotating-category options stand out for top-tier borrowers:

- Discover it® Cash Back: 5% quarterly categories with first-year match

- Chase Freedom Flex®: 5% on up to $1,500 in bonus spend

- U.S. Bank Cash+®: Customizable 5% categories

Elite Card Benefits

Visa Signature® and World Elite Mastercard® tiers offer extra protections. These include:

| Perk | Coverage Details |

|---|---|

| Purchase Protection | 120 days against damage/theft |

| Travel Insurance | Up to $500,000 on covered trips |

| Concierge Service | 24/7 travel/entertainment assistance |

“Lenders reserve their highest limits and lowest rates for borrowers with pristine credit,” notes a 2025 industry report. Yet even excellent credit scores sometimes face denials due to:

- Too many recent applications

- High existing balances

- Limited credit history length

For those who qualify, these rewards credit products offer unlimited cash potential. Just remember to maintain your score by keeping utilization below 10%.

Cashback Cards for Good or Fair Credit

You don’t need perfect credit to start earning money back on purchases. Even with a fair credit score (630–689), several options help you grow rewards while improving your financial standing. Secured and unsecured back credit products cater to this range, often with lower approval barriers.

Top Picks for Average Scores

The Capital One QuicksilverOne® offers 1.5% cash back on all purchases, even for scores as low as 580. Unlike secured options, it doesn’t require a deposit but has a $39 annual fee. For those rebuilding credit, the Bank of America® Customized Cash Rewards Secured card provides 3% in a category of your choice.

Four secured cards approving fair credit scores with deposits:

- Discover it® Secured: 2% back at gas stations/restaurants (up to $1,000/quarter)

- OpenSky® Secured Visa®: No credit check, $35 annual fee

- First Progress Platinum Prestige: Reports to all three bureaus

- Green Dot primor® Visa® Gold: 1.5% flat rate, no application fee

Credit-Building Tools

Issuers like Bank of America® include credit score trackers in their apps. These tools monitor progress and suggest limits for faster improvement. “Secured cards with rewards are rare but invaluable for rebuilding,” notes a 2025 NerdWallet report.

Use WalletHub’s approval odds calculator to gauge your chances before applying. Remember, consistent on-time payments matter more than your initial deposit amount.

Secured Cashback Credit Cards

Rebuilding your financial standing doesn’t mean sacrificing rewards. Secured cards require a refundable deposit but let you earn while improving your back credit history. They’re ideal if you’ve faced rejections for traditional options.

How Secured Cards Build Your Profile

Your deposit typically sets your limit, ranging from $200 to $2,500. Unlike prepaid cards, these report payments to all three bureaus. Timely usage can raise your credit score within months.

Compare two popular secured cards:

- Discover it® Secured: Earns 2% at gas stations/restaurants (up to $1,000/quarter) and matches first-year rewards.

- OpenSky® Secured Visa®: No hard credit check but charges a $35 annual fee.

Transitioning to Unsecured Cards

Most issuers review accounts for graduation after 12-18 months. The Bank of America® Customized Cash often returns deposits while upgrading users. Three cards that consistently report to bureaus:

- Discover it® Secured

- Capital One Secured Mastercard®

- Citibank® Secured Mastercard®

A 2025 NerdWallet study found users averaging a 72-point FICO increase in six months. “Secured cards with rewards accelerate rebuilding by creating positive habits,” notes their lead analyst.

Understanding APRs and Fees

Understanding financial terms can save you hundreds in hidden costs. Your card’s rates and fees determine whether rewards outweigh expenses. Focus on two critical areas: purchase APRs and penalty charges.

Intro APR vs. Standard APR

Introductory APR offers (often 0% for 12–18 months) seem appealing but have strict terms. Missing a payment or exceeding the promo period triggers the standard rate—up to 28.49% in 2025. *“Always mark the expiration date on your calendar,”* advises a 2025 WalletHub report.

Compare these common structures:

- Variable APR: Changes with the prime rate (e.g., 15.99%–25.99%).

- Fixed APR: Rare now; lenders can still adjust with 45 days’ notice.

Balance Transfer and Cash Advance Fees

Transferring a balance typically costs 3%–5% of the amount. Five cards with 0% balance transfer offers:

- Chase Slate Edge®

- Citi® Diamond Preferred®

- BankAmericard®

- Wells Fargo Reflect®

- Discover it® Balance Transfer

Cash advance fees are steeper—$10 or 5%, whichever is higher. Unlike purchases, interest starts accruing immediately at 25%+ APR. Avoid this trap unless absolutely necessary.

“Compound interest on unpaid balances can erase rewards. Pay in full during grace periods.”

| Fee Type | Typical Cost | When It Applies |

|---|---|---|

| Balance Transfer | 3%–5% | Moving debt from another card |

| Cash Advance | 5% or $10 | ATM withdrawals |

| Late Payment | Up to $40 | Missed due date |

Maximizing Your Cashback Rewards

Your wallet could work harder when cards complement each other’s strengths. Pairing the right plastic turns everyday spending into layered earnings. WalletHub’s 2025 data shows users who combine cards save 37% more than single-card holders.

Strategies for Higher Earnings

The 3-card combo works like this:

- Flat-rate card: 2% on non-bonus purchases (e.g., Citi Double Cash®)

- Rotating categories: 5% quarterly bonuses (e.g., Discover it® Cash Back)

- Fixed-category card: 3%-6% on top spending area (e.g., Amex Blue Cash Preferred®)

Track merchant category codes (MCCs) to avoid misclassified purchases. Big-box stores often code as:

- Wholesale clubs (not supermarkets)

- Department stores (not apparel)

- Business services (not office supplies)

Combining Cards for Optimal Rewards

Time large buys with quarterly rotations. For example, schedule appliance purchases during Q3 when some cards offer 5% back at home improvement stores.

| Retailer | Common MCC | Better Card Choice |

|---|---|---|

| Walmart Neighborhood Market | Grocery | Blue Cash Preferred® (6%) |

| Target | Discount Store | Flat-rate card (2%) |

| Starbucks inside Kroger | Restaurant | U.S. Bank Altitude® Go (4%) |

Authorized user loophole: Add family members to different cards to multiply bonus rewards caps. “Households using this tactic earn $200+ extra annually,” notes a 2025 NerdWallet study.

“Always check your statement’s MCC—not the store name—to confirm category eligibility.”

Cashback Cards for Specific Lifestyles

Different spending patterns call for specialized reward strategies. Whether you’re constantly on the move or sticking to neighborhood shops, certain products align better with your routine. The right choice depends on where your money goes most often.

Solutions for Frequent Travelers

Road warriors need cards that earn on transit and lodging. The Bank of America® Travel Rewards shines with 1.5% back plus no foreign transaction fees. Warehouse club options like Costco Anywhere offer 4% on gas—ideal for cross-country drives.

Compare top travel-friendly options:

| Card | Travel Rewards | Special Features |

|---|---|---|

| Bank of America® Travel Rewards | 1.5% all purchases | No foreign transaction fees |

| Costco Anywhere Visa® | 4% gas (up to $7k/year) | 3% restaurants/travel |

| Sam’s Club Mastercard® | 5% gas (up to $6k/year) | 3% dining |

Five cards with extended warranty protections:

- Chase Sapphire Preferred®

- Citi® Double Cash

- Wells Fargo Active Cash®

- U.S. Bank Altitude® Go

- American Express Blue Cash Everyday®

Everyday Purchases Maximized

For local spending, focus on grocery and pharmacy categories. Some stores code differently—Target often registers as a department store rather than supermarket. “Always verify coding by checking your first statement,” advises a 2025 NerdWallet report.

Pharmacy rewards exceptions to note:

- Walgreens and CVS sometimes qualify for medical spending

- Telehealth services rarely earn bonus rewards

- Over-the-counter meds typically code as general merchandise

“Grocery-store gas stations often code differently than standalone pumps—check your rewards portal.”

How to Apply for a Cashback Credit Card

Getting approved for the right rewards card starts with understanding your financial profile. Lenders review several factors when evaluating applications, from your payment history to current debt load. Knowing these requirements helps you target products matching your qualifications.

Credit Score Requirements

Your three-digit number determines which products you can access. Most issuers categorize applicants using these ranges:

| Score Range | Approval Likelihood | Card Examples |

|---|---|---|

| 720+ | High | Premium rewards cards |

| 690-719 | Good | Mid-tier products |

| 630-689 | Fair | Secured or basic cards |

Check your credit score through free services like Credit Karma before applying. This prevents unnecessary hard inquiries on your report.

Application Tips for Approval

Prequalification tools let you check eligibility without affecting your score. Five issuers offering this feature:

- Capital One

- Discover

- American Express

- Bank of America

- Chase

Each hard inquiry typically drops your score by 3-5 points. Space applications by 90 days to minimize impact.

Prepare these documents for income verification:

- Recent pay stubs

- Tax returns (self-employed)

- Bank statements

If denied, call reconsideration lines within 30 days. Have your account details ready to discuss approval options.

“Applicants who verify income upfront see 28% faster processing times.”

Five cards known for instant approvals:

- Discover it® Secured

- Capital One QuicksilverOne®

- Bank of America® Customized Cash Rewards Secured

- OpenSky® Secured Visa®

- Green Dot primor® Visa® Gold

Always review the cardmember agreement for terms before accepting an offer. This ensures you understand rewards structures and fees.

Common Mistakes to Avoid

Small oversights can cost you hundreds in missed rewards each year. Many users focus only on high percentages without checking the terms that limit earnings. These seven errors quietly drain your potential savings.

Pitfalls in Choosing Rewards Cards

Chasing sign-up bonuses often leads to overspending. Some cards require $3,000 in purchases within 90 days to earn $200. Calculate whether your normal spending hits these targets naturally.

Watch for these hidden reward caps triggers:

- Calendar-based resets (not billing cycles)

- Combined category limits (e.g., gas + dining)

- Merchant coding exceptions

Cards with annual fees only pay off if your spending offsets the cost. The $95 Blue Cash Preferred® fee requires $1,583 in grocery spending just to break even at 6% back.

How to Avoid Reward Caps

Strategic card combos prevent category overlap. Pair a 5% grocery card with a 3% dining product instead of two grocery-focused options. This expands your high-earning potential.

Five cards without grocery spending limits:

| Card | Reward Rate | Annual Fee |

|---|---|---|

| Alliant Visa® Signature | 2.5% all purchases | $99 |

| Capital One SavorOne | 3% groceries/dining | $0 |

| Bank of America® Premium Rewards | 3.5% groceries (Platinum Honors) | $95 |

Download our free cap-tracking spreadsheet template to monitor quarterly limits. It automatically alerts you when approaching category maximums.

“Cardholders who track caps earn 23% more than those who don’t.”

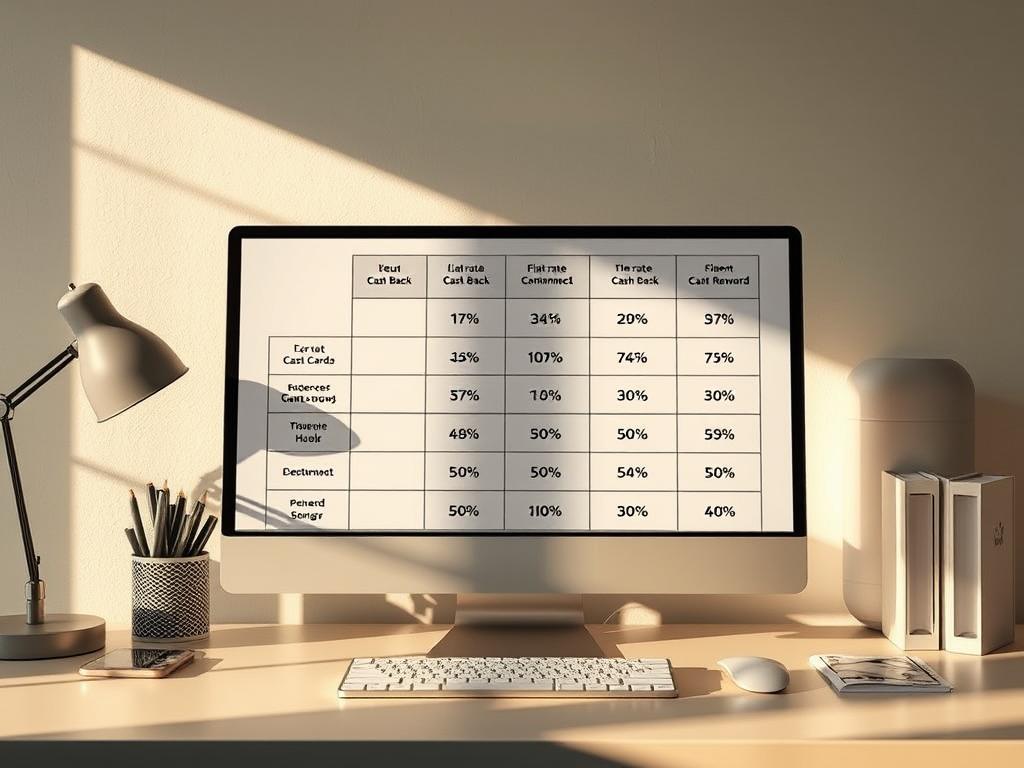

Comparing Cashback Cards Side by Side

Selecting between reward programs requires careful evaluation of multiple factors. WalletHub’s 2025 comparison tool analyzed 10 top products using a 40% rewards, 30% fees, and 20% benefits scoring system. This reveals which options deliver real value for different spending patterns.

Key Features to Look For

Focus on three areas when comparing options. First, examine reward rates—both base percentages and bonus category ceilings. The Amex Blue Cash Preferred® offers 6% groceries but caps at $6,000 annually.

Second, weigh fees against potential earnings. A $95 annual fee becomes worthwhile if you spend $1,583+ in 6% categories. Third, review redemption terms. Some issuers require minimum $25 balances before payout.

Example Comparisons

See how top contenders stack up:

| Card | Reward Rate | Annual Fee | Foreign Fee |

|---|---|---|---|

| Amex Blue Cash Preferred® | 6% groceries, 3% gas | $95 | 2.7% |

| Chase Freedom Flex® | 5% rotating categories | $0 | 3% |

| Citi Double Cash® | 2% all purchases | $0 | 3% |

International travelers should note foreign transaction fees. The Capital One Quicksilver charges 0% abroad, while others impose 3% surcharges. “These fees erase rewards on overseas spending,” warns WalletHub’s 2025 report.

For dynamic comparisons, use WalletHub’s interactive tool. It lets you filter by credit score, spending habits, and preferred terms to find your ideal match.

Conclusion

Maximizing your earnings requires staying updated on the latest reward trends. In 2025, more issuers offer flat-rate options above 3%, making it easier to earn without tracking categories.

Reassess your plastic annually—spending habits and market offerings change. Start by checking your credit score, then use comparison tools to match new opportunities.

Watch for reward devaluation. Some programs reduce rates or add restrictions quietly. Tools like WalletHub’s card matcher simplify finding fresh fits.

Act now to ensure your wallet works as hard as you do.